Reading time: ~18 minutes

Contents of this article:

Key Facts - Summary

Business Overview

Fundamentals

Corporate Governance

Valuation

Conclusions

1. Key Facts - Summary

Fundamentals (10-year average)

Profitability: 16% ROCE, 14% ROA, 18% ROE

Financial strength: Net cash position, 1.23x equity multiplier

Growth: 8.3% 10Y revenue CAGR

Shareholder remuneration:

1.4% Dividend yield

Non-recurrent share buybacks

Valuation

2.8% FCF yield

3.2% Earnings yield

Too long; Didn’t read

Garmin is a technology company with a broad and diversified product portfolio orbiting around GPS technology. Thanks to its five business divisions (Fitness, Outdoor, Aviation, Marine, and Automotive), the company delivers a Return on Invested Capital of ~15%, well above its cost of capital. Combined with a clean balance sheet with no debt and a successful growth path in recent years, Garmin shows signs of a high-quality company.

However, the competitive landscape in the Fitness segment is currently very challenging and the automotive segment is still not profitable after strong investments from management.

At the moment, valuation is too challenging for an investment. The current multiples provide very little margin of safety and investors should be cautious when starting a new position. Nevertheless, Garmin deserves a spot in the watchlist and may become a profitable venture if Mr. Market gifts investors with a better opportunity.

2. Company Overview

Garmin is an American multinational technology company that designs, develops, manufactures, and distributes GPS-enabled products and other navigation and communication equipment.

Founded in 1989 as ProNav by GARy Burrell and MIN Kao, Garmin is widely known for its fitness and outdoor watches. However, the company’s initial product was the GPS 100, a GPS unit designed for boaters. In its first decade, Garmin expanded its offerings to include products like the GPS 155, the first aviation navigation system certified for Instrumental Flight Rules (IFR), and StreetPilot, a portable navigation system for cars.

In 2003, the company introduced the Forerunner 201, the first fitness smartwatch for runners.

Fast-forward to 2025 and Garmin has grown into a multinational company with over 300 million products delivered, 21,000 employees, and manufacturing facilities in Taiwan, the United States, the Netherlands, Poland, and China.

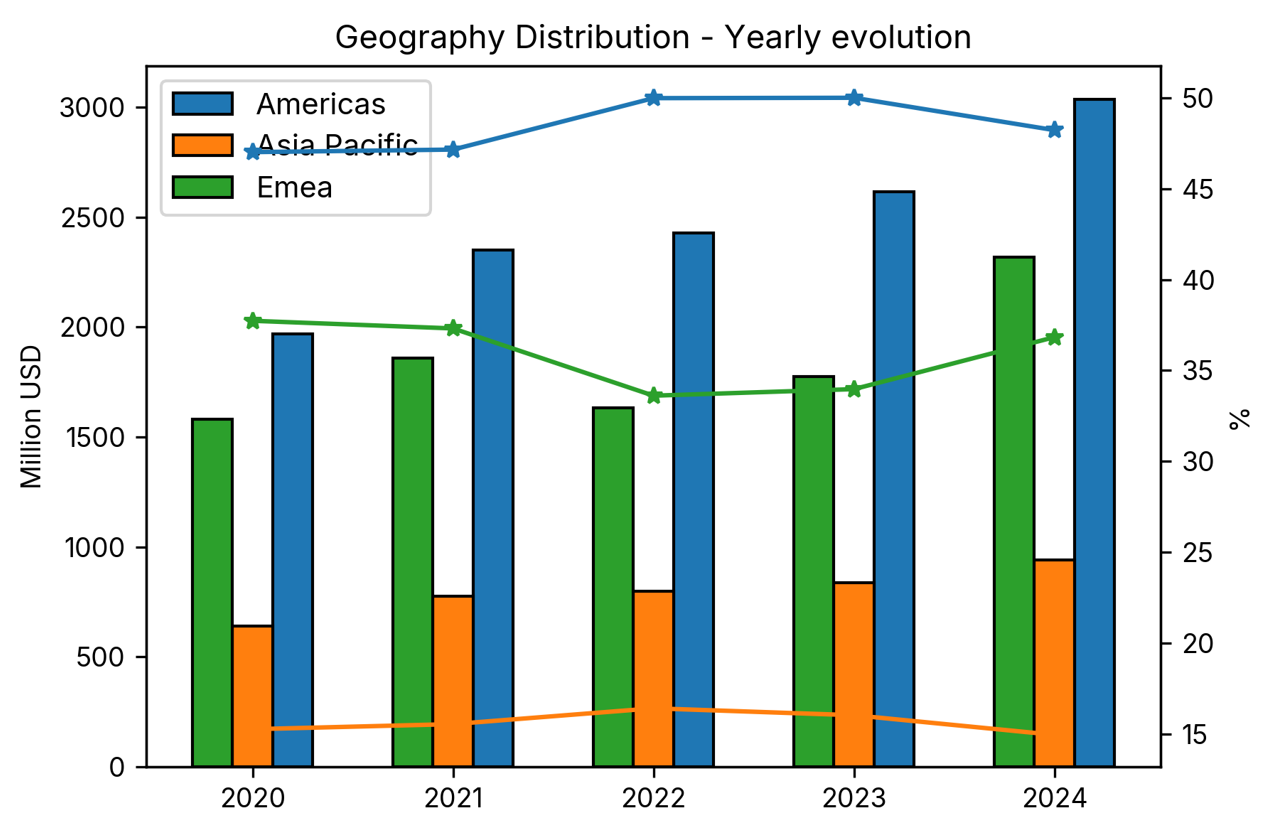

Geographically speaking, Garmin derives most of its revenue from the Americas region (48%), followed by Europe, Middle East, and Africa (37%), and Asia Pacific (15%).

2.1. Business segments

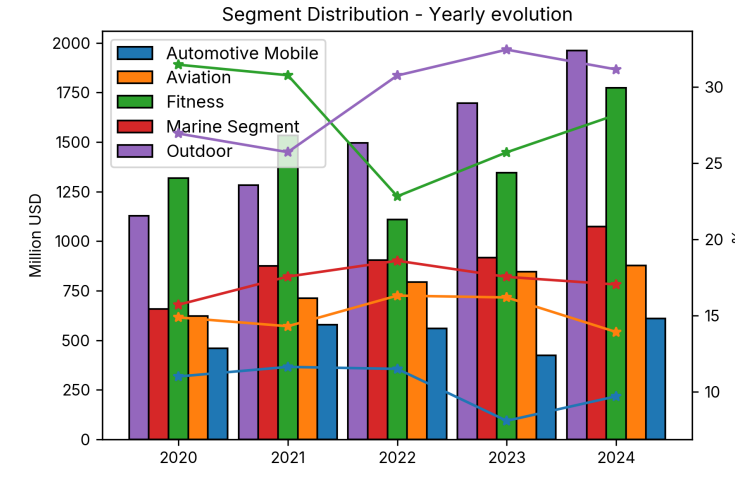

The company now focuses on five primary markets: Outdoor (31% of revenue), Fitness (28%), Marine (17%), Aviation (14%), and Auto OEM (10%).

Garmin’s product portfolio across all segments relies on its core GPS technology, fostering synergies divisions through seamless transfer of technology.

Fitness and Outdoor

For the scope of this analysis, I will combine the Outdoor and Fitness segment. Both segments provide a well-diversified product portfolio to a wide range of customers, from serious and/or professional athletes to health-conscious individuals and casual users.

The Outdoor segment provides a broad range of products designed for various outdoor activities. Its core products are adventure watches marketed under the fēnix®, Instinct® series, tactix®, Enduro™, and MARQ® series. These watches emphasize performance and durability, featuring capabilities like night vision compatibility, stealth mode, topography, and built-in LED flashlights. Most importantly, these watches command a much higher price range than the average sportswatch. For example, the MARQ® Commander (Gen 2) sells for $3,200.

Other products offered under this segment are the inReach® and Garmin Response emergency services, handhelds and satellite communicators (Montana®, eTrex®, GPSMAP®), golf devies (Approach®), consumer automotive products such as Personal Navigation Devices (PNDs) and dash cams, sportsman devices (Xero®) used by hunters, long-range shooters and airgun and airsoft users, dog training and tracking devices (Alpha®, PRO, BarkLimiter™, Delta®) and dive devices (Descent™).

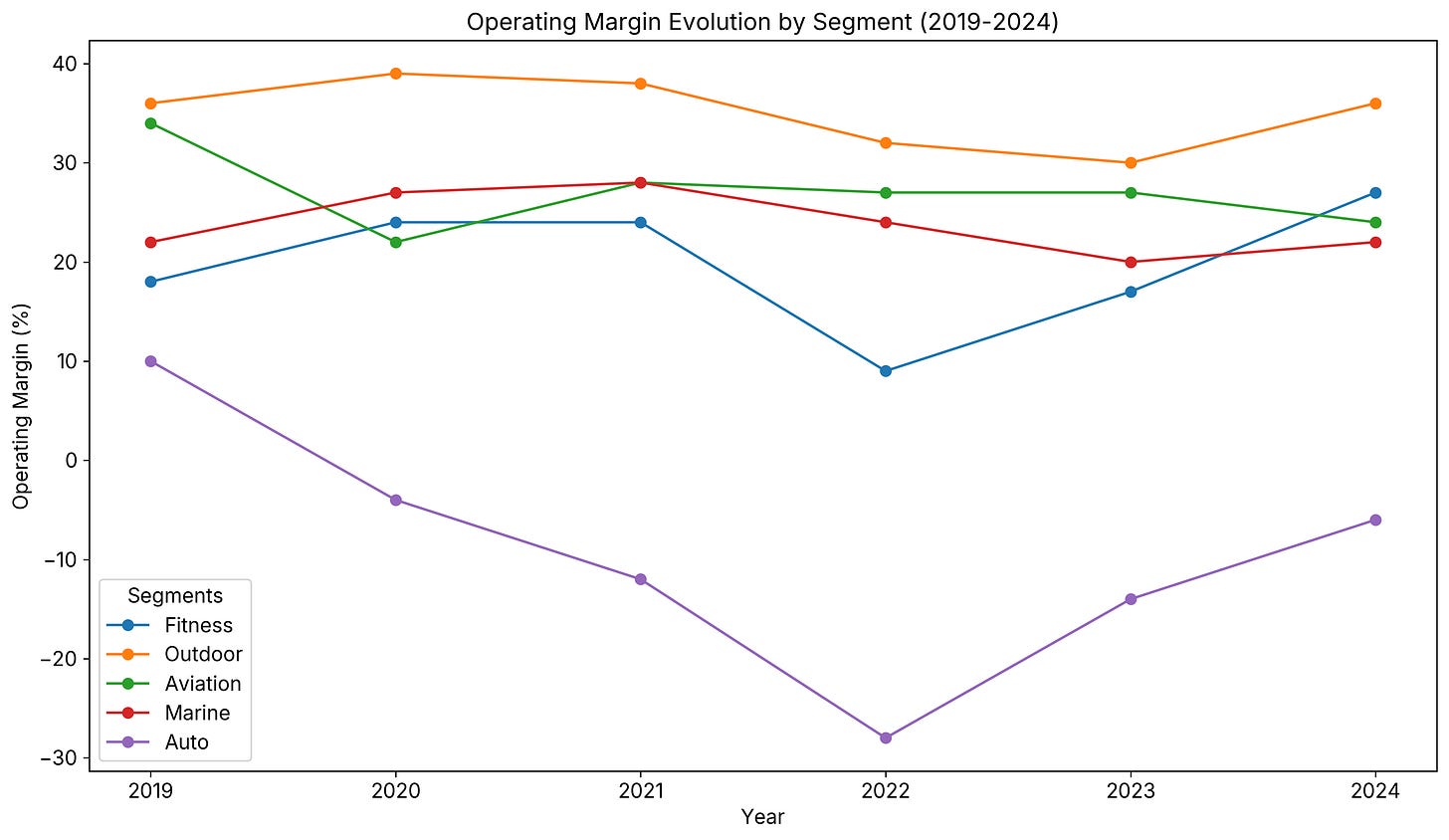

Thanks to its specialised nature, these products command premium pricing and have allowed the Outdoor segment to be the the most profitable for the company, with operating margin regularly over 30% in the last five years.

The Fitness segment targets general health, wellness, and fitness activities, primarily focusing on running and multi-sport watches (Forerunner® series) and cycling products. Lately, Garmin has also developed smartwatch devices that combine advanced sports features with an elegant design.

Running and multi-sport watches are marketed under the Forerunner® series. Garmin has a wide portfolio of sportswatches, from the basic Forerunner® 55 ($200) to the highly advanced Forerunner® 970 ($750). These watches focus on high GPS precision, healthcare features and long-lasting battery life.

Cycling products include cycling computers, power meters, bike radars, cameras, smart lights, and speed and cadence sensors. Garmin also offers indoor training equipment under the Tacx® brand, with prices up to $4,000 for the Tacx® NEO Bike Plus.

Smartwatch devices are marketed under the Venu®, vívoactive®, vívomove®, Lily®, vívosmart®, and Bounce™ series. These watches sacrifice some sports-based features from the Forerunner® series in exchange for a sleeker design suitable for a daily usage.

In addition, Garmin also sells smart scales and monitors and its web and mobile platforms Garmin Connect™.

While each product line has certain niche competitors, the biggest threats to Garmin are now located in the multi-sports and adventure watches:

Apple, Samsung, Google and other consumer electronics companies: with the Apple Watch Ultra, the Galaxy Watch series, or the Pixel series, Apple, Samsung, and Google offer alternative high-end outdoor smartwatchs at a price-point comparable to Garmin’s products.

Suunto, Polar, Coros, and other companies specialized in sportswatch: Suunto and Polar possess a similar product range and are long-lasting competitors to Garmin. In recent years, chinese company Coros has gained popularity as a cheaper alternative to Garmin.

Tag Heuer, Tissot, Casio and other watch manufacturers: Standard watch manufacturers are entering the sports and smartwatch industry by tackling the challenge of combining the feeling of a luxury brand with the new sports and smartwatch features requested by the market.

It is difficult to evaluate Garmin’s market share in the sports and smartwatch industry. Many of its competitors also offer a wide range of products without a clear revenue breakdown in its financial statements. Estimates suggest that Garmin holds a 4% to 8% market share in the industry.

Consequently, Garmin’s strategy is not focused on serving the entire market, but rather to provide high-quality, differentiated products. This is clearly visible by its high gross margin (55% to 65%) and operating margin (25% to 30%) for both segments. This strategy may work for the Outdoor product range, but it will become increasingly difficult for Garmin to differentiate itself from other companies in the Fitness product range.

Based on the amount of existing brands and the rate of new entrants, it is highly likely that there is no moat for Garmin in the fitness segment. In fact, Garmin might lose market share against the big players due to the strong network effects and switching costs generated by the likes of Apple, Google, and Samsung. These giants are able to create a broader ecosystem revolving around their products (e.g., iPhone, iPad, Apple Watch, AirPods, etc) and possess higher brand power. Garmin can only maintain its competitive edge through significantly superior battery life, which may not be enough for the average user.

In contrast, Garmin is more protected against new entrants in the Outdoor segment thanks to the specialised nature of its products, which are perceived as industry standard for hardcore sports like scuba diving, rock climbing and long-distance activities. This premium approach generates a moat for Garmin (albeit narrow) based on switching costs, giving Garmin pricing power. Many of the brands that have entered the low segment range (i.e., products in the Fitness division) may be reluctant to manufacture and sell higher-range devices due to higher development costs.

Marine

Garmin is a leading manufacturer of recreational marine electronics: chartplotters and Multi-Function Displays (MFDs), cartography, fishfinders, SONAR, autopilot systems, RADAR, radios, handhelds and wearable devices, sailing, audio, digital Switching, trolling motors, and lightning.

Garmin has succeeded in creating a comprehensive ecosystem for its customers. Garmin’s primary customer base in the marine segment is overwhelmingly the recreational boating market (e.g., anglers/fishermen, leisure boaters, sailors, yachts). Boaters can connect chartplotters, SONAR, radar, autopilot, and even engine data for a smooth and interconnected experience.

However, Garmin struggles serving large commercial vessers typically dominated by companies like Furuno or goverment and defense vessels which are usually supplied by major defense contractors such as RTX or Thales.

As of 2024, it is the third biggest business segment with stable operating margin around ~25%.

For this segment, Garmin lists fewer competitors: Furuno, Johnson Outdoors, Navico (Brunswick), and Raymarine (Teledyne).

Furuno (~$725 million revenue) is a Japanese company with a long-standing reputation for high-quality, robust marine electronics. They offer radars, fish finders, chartplotters, and navigation systems. Furuno is seen as a superior company in terms of commercial-grade reliability, with many commercial operators preferring Furuno, whereas Garmin can better compete in the recreational segment.

Johnson Outdoors (~$430 million revenue) owns several marine brands (Humminbird, Minn Kota) and is a strong competitor in freshwater fishing thanks to its advanced sonar technologies and high-definition fish finders.

Navico (~$800 million revenue) is a major marine electronics group under Brunswick Corporation that offers a broad and competitive portfolio on par with Garmin, especially in certain nice areas.

Raymarine (~$370 million revenue by Teledyne’s Instrumentation segment, which includes Raymarine) is a strong competitor in the recreational marine market, offering similar functionality and price points as Garmin.

By comparing the size of their competitors, we can conclude that Garmin ($876 million revenue) is a leading player in the marine electronics market, but faces substantial competition from well-established and specialized companies. The vertical integration of its systems increase switching costs for recreational boaters and protect Garmin from competition and new entrants.

The marine segment is on par with other business segments in terms of profitability, with a 55% gross margin and stable operating margin between 20% and 25%.

Aviation

The company is also a leading provider of electronics equipment for the aeronautical sector (avionics).

Garmin’s aviation segment possesses significant contracts with leading aircraft manufacturers like Airbus Helicopters and Deutsche Aircraft, supplying Flight Management Systems (e.g., GTN 750, unit price ~$12,000) and avionics suites for various aircraft models including the H130/H145/H145 helicopters and the new D328eco aircraft. It also supplies the G1000 Nxi Integrated Flith Deck (unit price ~$50,000) for popular general aviation planes like the Cessna 172 and the G3000 Prime Flight Deck for the PC-12 Pro and PC-7 MKX military training aircraft from Pilatus.

Competition is strong in this segment and includes smaller, specialized players (e.g., Aspen Avionics, Avidyne, Dynon Avionics), companies with slightly different core focuses (e.g., Safran) and giants of the industry which pose a direct threat and competition to Garmin (e.g., Honeywell, Collins, Thales).

Honeywell Aerospace & Defense ($15 billion in revenue) and is an American aerospace giant, providing a vast array of systems including engines, avionics, and navigation systems for commercial, defense and general aviation.

Collins Aerospace ($29 billion) is part of RTX Corporation, one of the largest aerospace and defense suppliers globally.

Thales (€21 billion) is a French multinational company and a strong supplier in the European aerospace sector.

The revenue of the above-listed companies is roughly 17, 32, and 25 times larger than Garmin’s aviation segment, which allows them to scale better and become important suppliers for the large aircraft markets. If Garmin tries to expand to the big OEM market (e.g. Airbus, Boeing), it will have to compete with these giants. Not surprisingly, Garmin mainly focuses on the general aviation, business jets and the rotorcraft market.

Similarly to the marine segment, the aviation division possesses strong barriers to entry for new entrants due to the high development costs and the strict regulatory framework associated with aeronautical products. Moreover, switching costs for customers are high: once they decide to integrate Garmin’s avionics products into their aircrafts, changing supplier is very often not a feasible option due to the strong efforts needed for certification. This is further emphasized as the products supplied by Garmin are usually critical to the safety of the aircraft.

Auto OEM

Finally, the Auto OEM segment provides hardware and software solutions for automobile manufacturers:

Domain controllers

A domain controller is a centralized computer that manages and controls a set of related vehicle functions within a specific “domain”. The domain controller replaces the individual Electronic Control Units (ECUs) that were traditionally part of old cars. For example, Garmin supplies domain controllers for Advanced Driver-Assistance Systems (ADAS). These systems process data from cameras, radar, LiDAR, and other sensors in order to enable features like adaptive cruise control, automatic emergency braking, and lane-keeping assistance.

Infotainment Units

Infotainment units are digital systems that combines various functions to enhance driving and passenger experience. This is basically the high-resolution touchscreen display in the center console of many cars, from which the radio, air conditioning system, navigation, connectivity, and other functions can be controlled.

This segment experienced an operating loss in FY2024 and expects the segment to suffer again an operating loss in 2025. Despite these operating losses, management will continue making significant investments in the Auto OEM business, as Garmin has been awarded several tier-one and tier-two auto OEM supplier contracts that need to be fulfilled.

Revenue for the auto OEM segment increased 31% to $169 million, primarily driven by increased shipments of domain controllers to BMW.

Despite sustaining losses since 2018, management remains stubborn, and continues to invest in this segment with a clear ambition to become profitable in the short-term future:

FY 2024 earnings release:

[…] we believe this business is a mid-teens kind of gross margin and kind of mid-single digits operating margin. And that’s clearly what we’re still driving for. We have been successful in securing new business for the future, including the one that I mentioned that is coming in 2027, representing our largest win to date and other smaller wins across the globe that help fill in both in terms of volume as well as margin profile that helps support that outlook that I mentioned.

Garmin competes with Alpine Electronics, Aptiv, Bosch, Continental, Harman (Samsung), Panasonic, and Visteon. These companies are significantly larger than Garmin and represent strong competition for the company’s auto OEM segment. For this reason, Garmin tries to focus on specific, high-growth, high-value niches within the automotive OEM market, particularly infortainment and digital cockpit domain controllers.

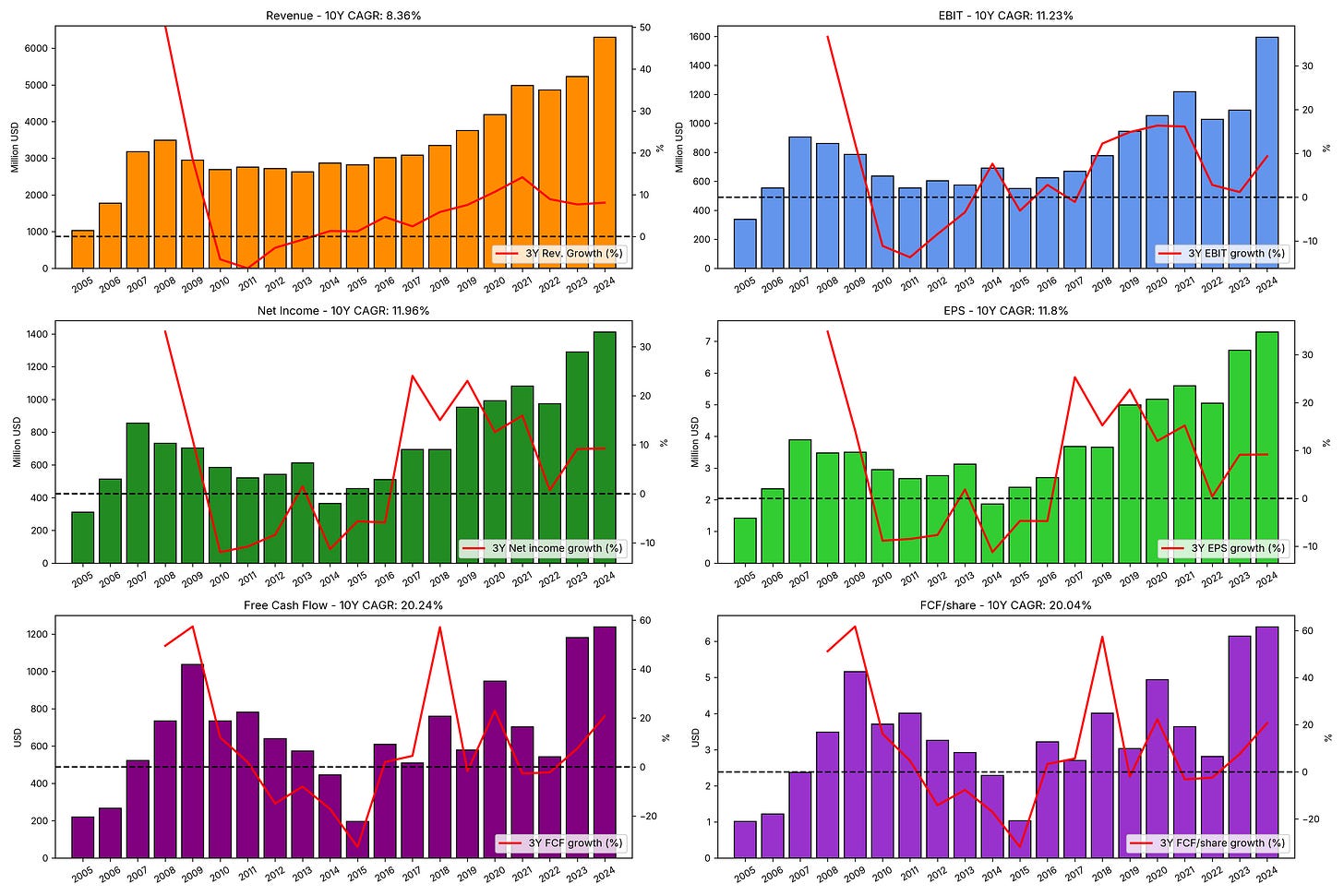

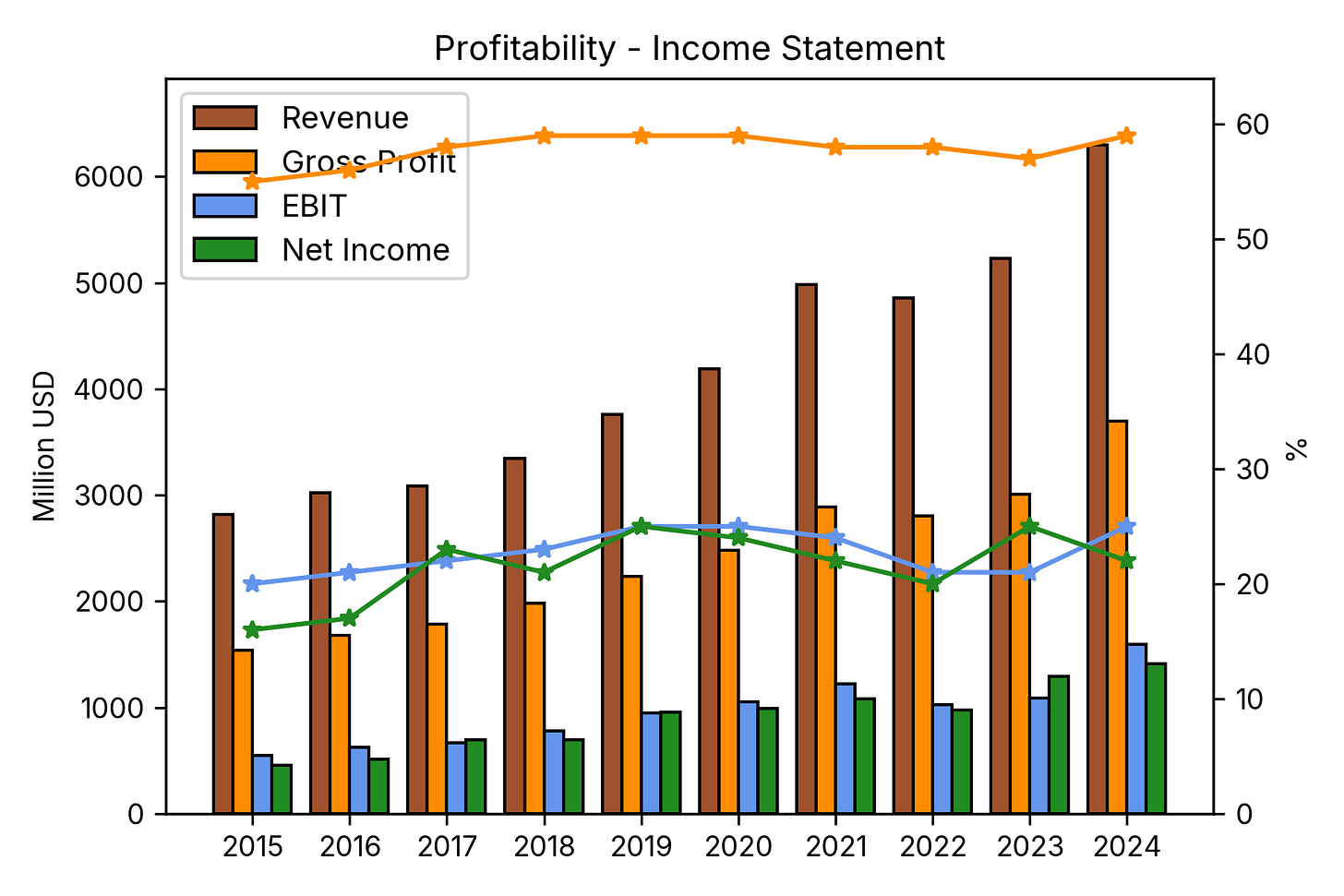

3. Financial performance

Garmin has remained profitable every single year for the last two decades, even during the Great Financial Crisis. This is a positive sign and shows how resilient the business is. The last two years have been particularly impressive and EPS has increased by 44% since 2023. These two years might prove to be a challenging comparative baseline in the future.

As explained later, the company stagnated from the late 2000’s until the early 2010’s when the automotive division suffered from the breakthrough of the smartphone, but the company has been able to reposition itself as a key supplier in the aviation and marine segments while providing high-quality watches for recreational athletes.

3.1. Profitability

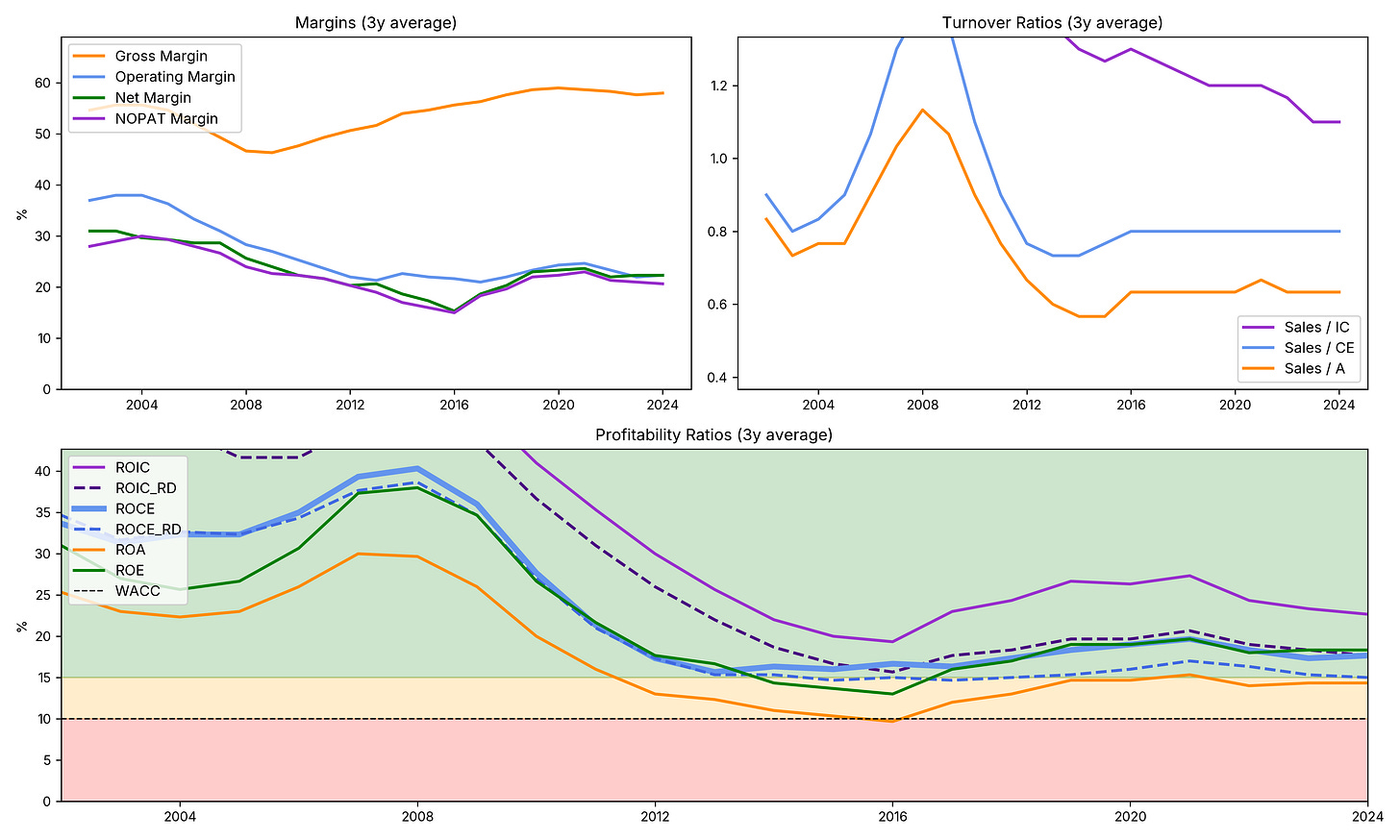

From a quantitative point of view, Garmin has successfully maintained a high Return on Capital Employed (ROCE) during the last two decades. While a 15-20% ROCE generates shareholder value (exceeding the cost of capital), it remains below Garmin’s peak 45% ROCE in the late 2000’s.

The best performance years for Garmin lasted between 2005 and 2008 and were quickly marked by the rise and fall of Personal Navigation Devices (PNDs) in the automobile segment, mainly represented by the nüvi product line. While the aviation, marine, and outdoor/fitness segments grew at remarkable CAGRs of 12%, 9%, and 22%, respectively, automotive's revenue exploded and grew at a 84% CAGR during those three years ($403 million → $2,538 million).

Garmin could not dwell in its success and sales were quickly eroded by a new technological breakthrough: the smartphone. Additionally, increasing vehicle integration of GPS further reduced customer demand. This combination effectively eliminated the market, causing the automotive / mobile segment to shrink as rapidly as it had previously grown. Since 2008, this segment has systematically reported negative revenue growth and has not been able to recover.

Nonetheless, Garmin has shown its resilience by maintaining a respectable ROCE of 18-20% (~15% if adjusted for R&D capitalization) thanks to a diversified product portfolio.

Garmin’s gross profit margin of ~58-60% shows that the company has a certain degree of pricing power and product differentiation. The combined operating margin across all divisions is consistently over 20%, which indicates that the company is an efficient executor. With FCF margins of 20% in FY2024 and 23% in FY2023, Garmin also demonstrates robust cash conversion.

3.2. Financial Strength

Balance Sheet is spotless. Garmin carries no debt and has a cash position of $2,675 million (35% of revenue, 5% of market cap). Consequently, the company does not pay any interest. In fact, it generated $113 million in interest income in FY2024 (3.3% return on cash).

Therefore, Garmin is in no risk of bankruptcy in the short term and is well-positioned to deploy its cash or raise new capital via debt in order to pursue new business opportunities, expand production, or remunerate shareholders.

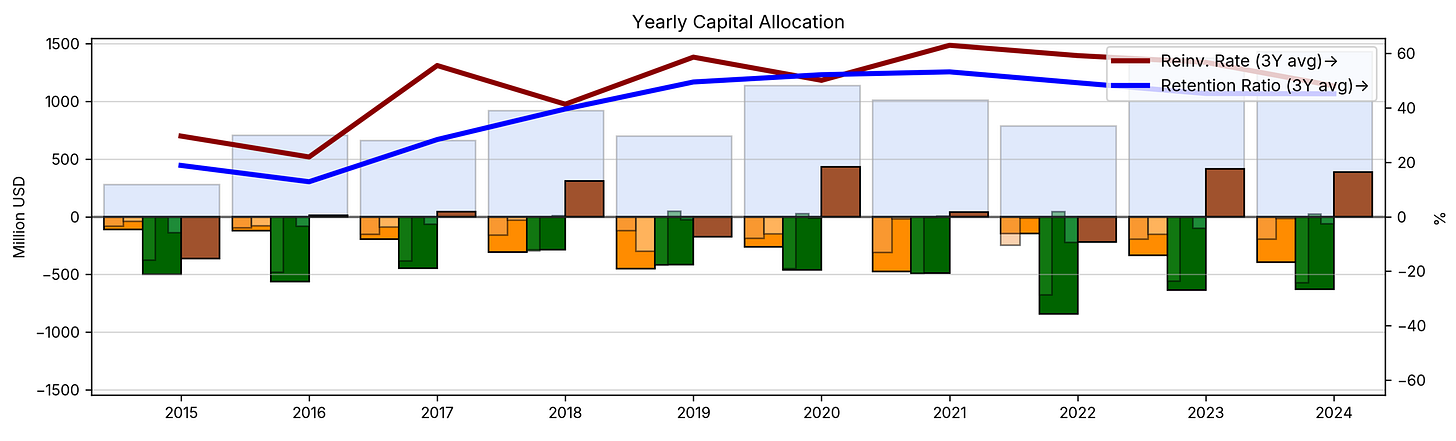

3.3. Capital Allocation

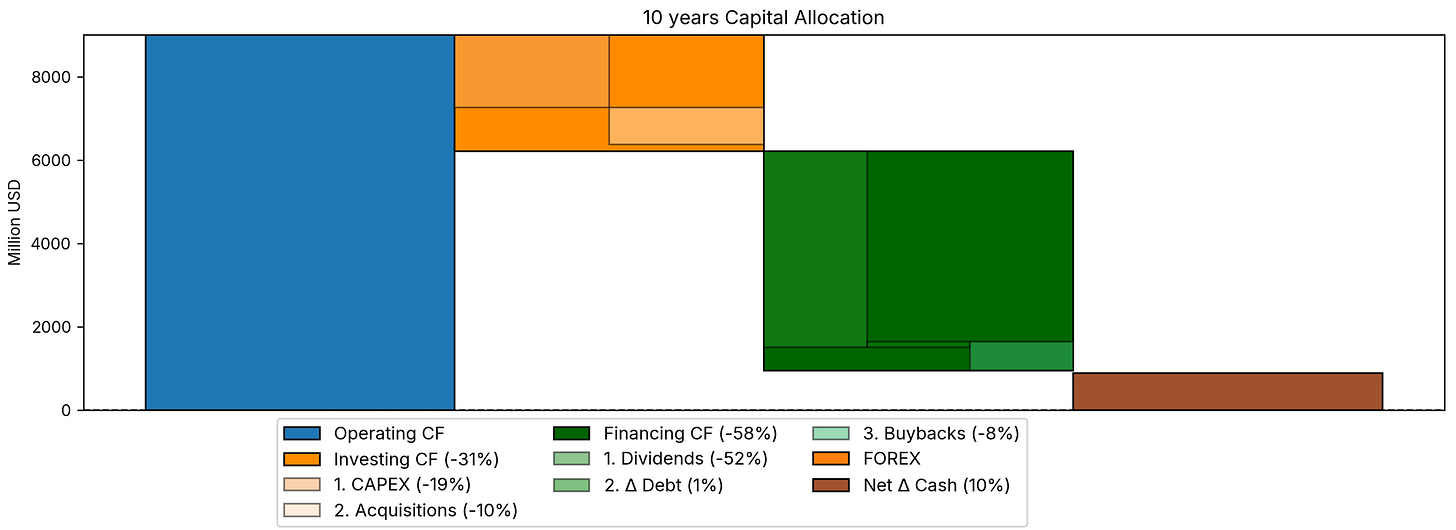

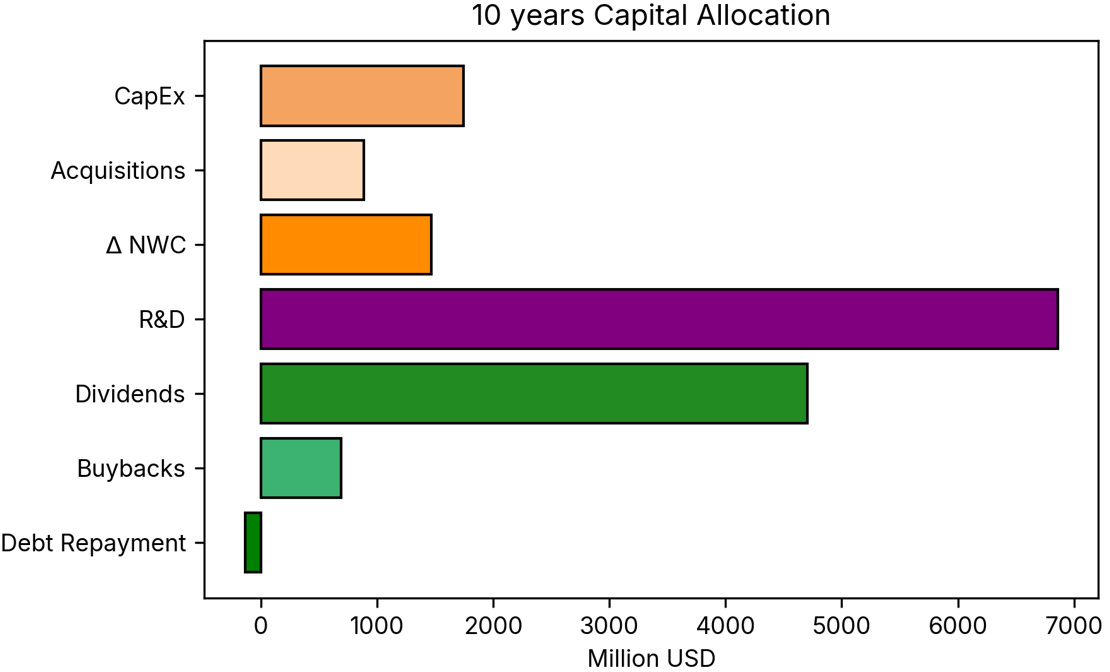

From an accounting perspective, most of Garmin’s capital is allocated to shareholder remuneration via cash dividends. CapEx is relatively low (~19-20% of operating cash flow) and the company regularly engages in acquisitions if it sees a strong opportunity.

Shareholder buybacks are infrequent, and the total number of shares has remained stable during the last decade, with only a slight increase due to stock remuneration schemes.

However, a significant portion of Garmin’s true capital allocation is not visible in the cash flow statement and is expensed directly on the income statement via Research & Development expenses (R&D). This ongoing investment is crucial for maintaining its competitive edge, with Garmin consistently allocating 16-18% of revenue in R&D.

Organic reinvestment rate (ΔNWC + CapEx - Depreciation) is quite volatile year after year but averages ~23-25%. However, if we consider the important investments in R&D and previous acquisitions, the total reinvestment rate increases to ~50-55%. Inorganic growth via acquisitions typically consists of small and medium sized companies that typically focus on a niche product (e.g., Tacx, FitPay) and complement well Garmin’s product portfolio.

If the company is able to maintain its ROCE and reinvestment rate, Garmin may offer sustainable earnings growth of 7-9%.

4. Corporate Governance

Garmin’s Board of Directors is composed of six individuals, four of which must be independent directors. The six directors have an average tenure of ~14 years, a positive sign of stability and long-term view for the company. Among them, co-founder Min H. Kao possesses over 30 years of experience in Garmin’s operations. Min H. Kao owns more than 18 million shares (over $4,000 million).

Overall, Directors and Executive Officers as a group (10 persons) own more than 15% of the company. This clearly indicates that their interests are aligned with those of the shareholders.

As for their remuneration, the company follows a standard scheme of base pay and stock-based awards via Restricted Stock Units (RSU). This compensation plan is based on two simple metrics: revenue and operating income. In the last three years, management met the targets by 0% (2022), 147.2% (2023), and 175% (2024).

5. Valuation

Garmin is currently trading at $232 per share and the following valuation multiples:

PE 31.7x (FY 2024); PE 28.5x (TTM)

P/FCF 35.7x (FY 2024); P/FCF 39.7x (TTM)

Note that equity multiples and EV multiples are essentially the same as the company has a net cash position.

Over the last twenty years, valuation multiples have oscillated between a PE of 10x amidst the Great Financial Crisis and the current peak. A more stable metric, Price/Sales, also shows that Garmin is currently above the average.

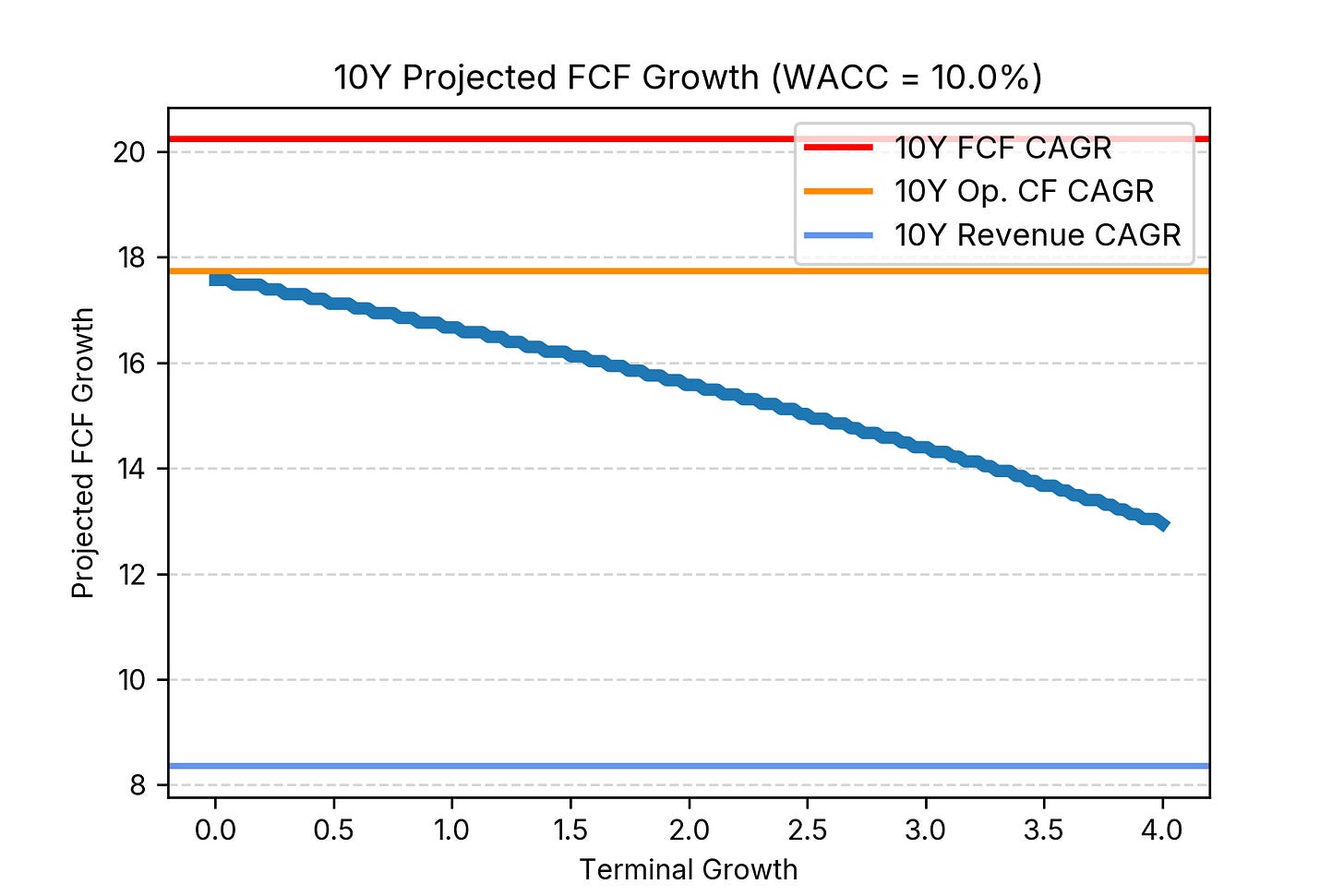

At this point, the article could stop here and we could quickly conclude that Garmin is most likely overpriced. Nevertheless, for the sake of completion, this chapter will be followed by a simple reverse discounted cash flow analysis in order to evaluate what the market expects from Garmin.

As we can see, the market expects Garmin to grow at slighly reduced rates with respect to the performance of the last decade. Since 2015, Garmin grew its free cash flow at a 20% CAGR. This value is not realistic, as free cash flow in 2015 was only $196 million. If we take the previous year, free cash flow was $445 million and Garmin grew at a 10% CAGR since, which is lower than what the market expects for the next decade.

Depending on the selected terminal growth rate (0% to 4%), Garmin should grow its free cash flow from $1,200 million to $4,100 million or $6,200 million (CAGR 12.9% to 17.6%) for a 10% rate of return. Considering the pressure from competition in the Fitness segment and the struggles in the automotive field, it seems unlikely that the company will be able to achieve such an outstanding performance. An extremely reduced number of companies has been able to perform at this level for a whole decade since records exist. This is aggravated by the fact that FY2024 and FY2023 were already great years, with FCF over $1,100 million in both years compared to $542 million in FY2022.

Another way of analysing the value of a company is to estimate ist current Earnings Power Value (EPV). The methodology is explained in the book Value Investing: From Graham to Buffet and Beyond from Bruce C. Greenwald, Judd Kahn, Erin Bellissimo, Mark A. Cooper, and Tano Santos.

In this case, there is no need to overcomplicate the calculation of EPV. Net Operating Profit after Taxes (NOPAT) for FY2024 was $1,300 million. With a net cash position of $2,675 million, we can estimate the current value of Garmin’s earnings at $15.7 billion, which is equivalent to 35% of the market capitalisation. In other words, 65% of Garmin’s value is allocated to the future.

Personally, I do not feel comfortable when a company is valued at such challenging multiples, especially considering the future challenges that Garmin has ahead.

6. Conclusion

Garmin shows traits of a high-quality company and deserves to be on the watchlist of any investor. It has succesfully become a leader in many of its divisions by delivering high-quality products in a profitable way. Its products are in high demand and this is clearly shown by the recent revenue growth. ROIC/ROCE is well above the cost of capital and the balance sheet is clean and robust. The recovery path after the downfall of the automotive division also shows that the company adapts to new trends and technologies.

On the negative side, there is pressure from competition, especially in the fitness segment by strong companies such as Apple, Google, and Samsung, and the automotive division will continue to drag profitability down in the short term.

Valuation is very challenging. With the current valuation multiples, the company is priced for perfection. Consequently, margin of safety is not enough to ensure a successful investment in the company.